Business Invoice Template

About this document

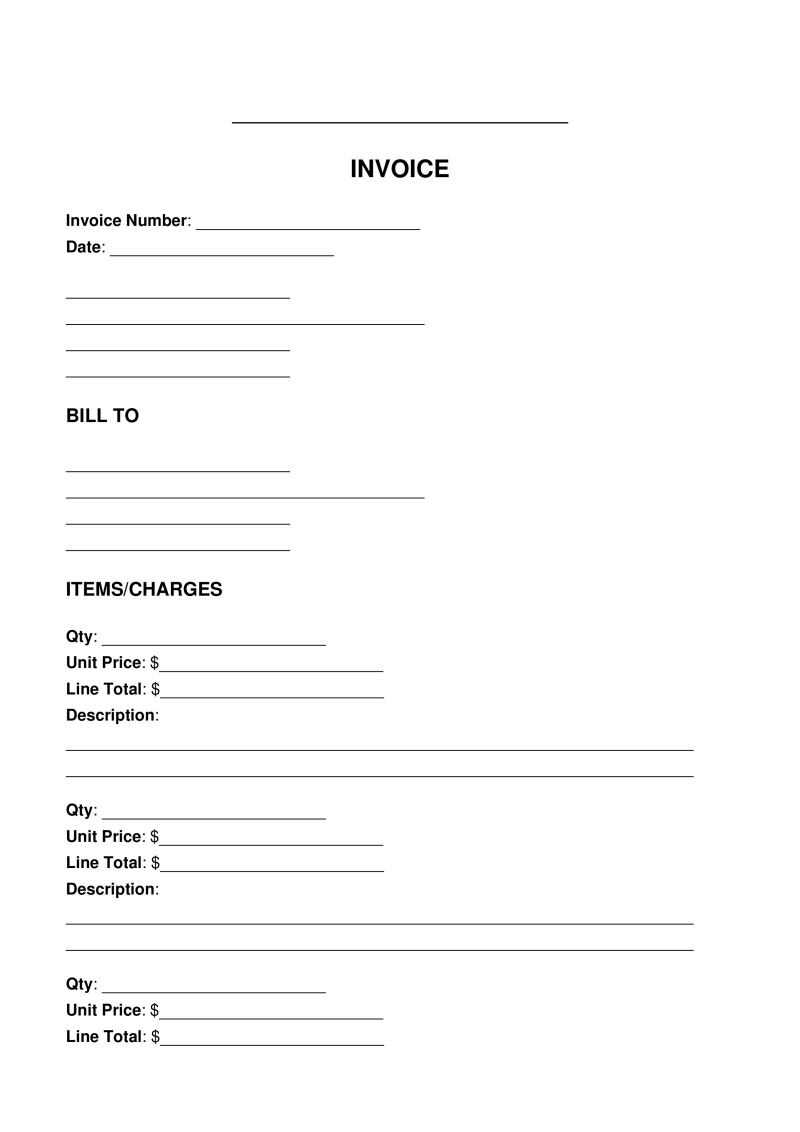

A business invoice is a financial document issued by a company or independent contractor to clients as an official request for payment and/or legal transaction record.

How to Create a Business Invoice

Step 1: Set Up Your Template

Design a professional template with your company logo, business name, and contact information prominently displayed. Include space for your tax identification number and any relevant business registration details.

Step 2: Include Required Information

Your invoice must contain comprehensive transaction details for proper processing and record-keeping. Start with the basics: a unique invoice number, issue date, and payment due date. Include your complete business information alongside your client's full business details. Clearly describe each product or service provided, with corresponding quantities and prices.

- Specify subtotal, applicable taxes, and final amount due

- Detail payment terms and accepted payment methods

- Include your banking or payment processing information

Step 3: Maintain Professional Formatting

Ensure consistent formatting with clear section headings. Use a legible font and organize information logically. Make important details like the total amount and due date easily noticeable.

Discussion

0 commentsComments and opinions expressed by users on this website are for informational purposes only and do not constitute legal advice. They reflect the personal views of the commenters and should not be relied upon as a substitute for professional legal counsel. Always consult a qualified attorney for advice specific to your situation.

Comments (0)

Leave a Comment

No comments yet. Be the first to comment!