Bill of Sale

About this document

A Bill of Sale is a document transferring ownership of personal property, like vehicles or furniture, between a buyer and a seller.

By Type

How to Write a Bill of Sale

A bill of sale serves as a formal record documenting the transfer of ownership from seller to buyer. This document is crucial for protecting both parties in a transaction. Let's walk through the process of creating and using an effective bill of sale.

1. Pre-Transaction Preparation

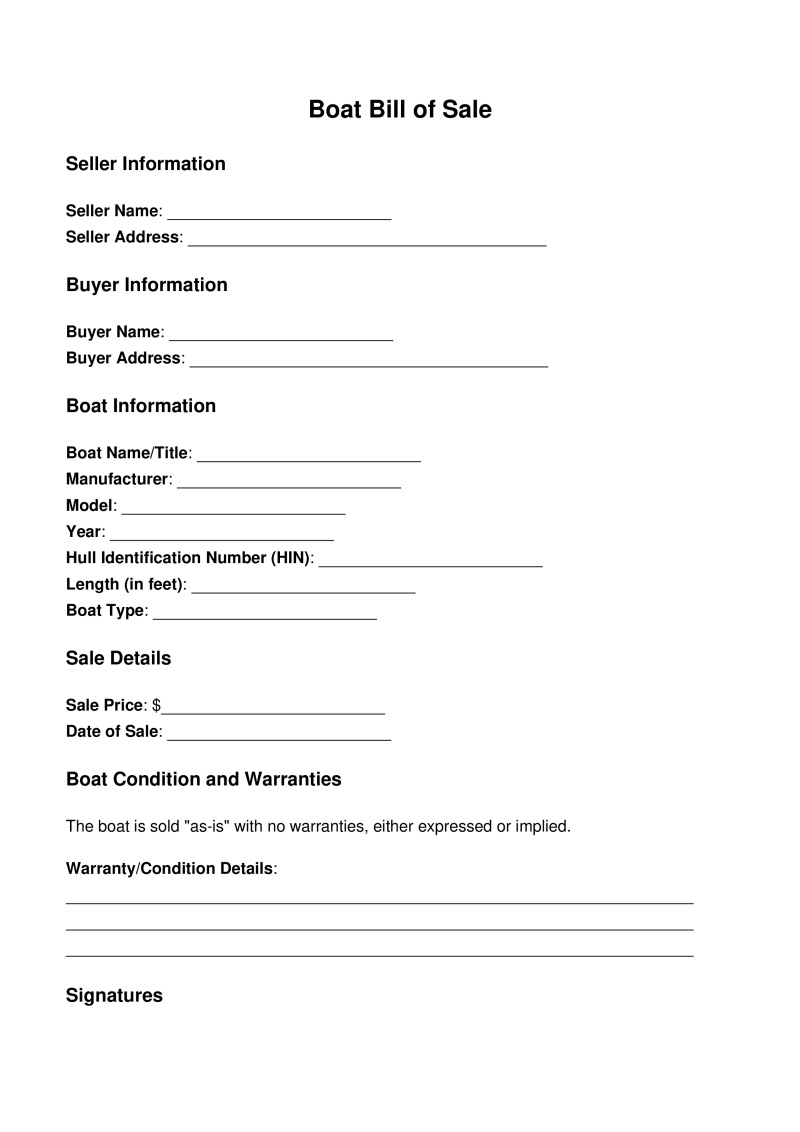

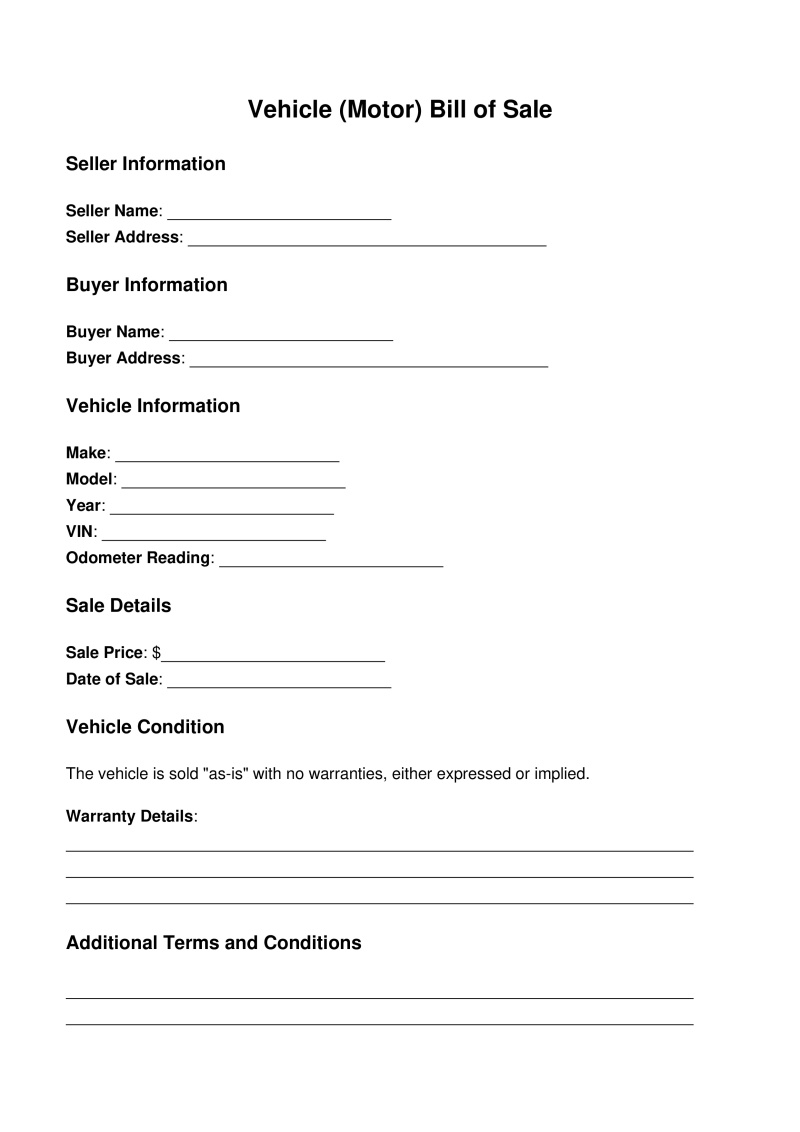

Begin by selecting the appropriate bill of sale template for your specific asset (vehicle, boat, firearm, etc.). Different assets may require different information and formats. Take time to research your local and state requirements regarding documentation needed for the property transfer, as these can vary significantly by jurisdiction. Before proceeding, verify the ownership status of the asset and gather all relevant identification numbers such as Vehicle Identification Numbers (VIN), Hull Identification Numbers (HIN), or serial numbers.

2. During the Transaction

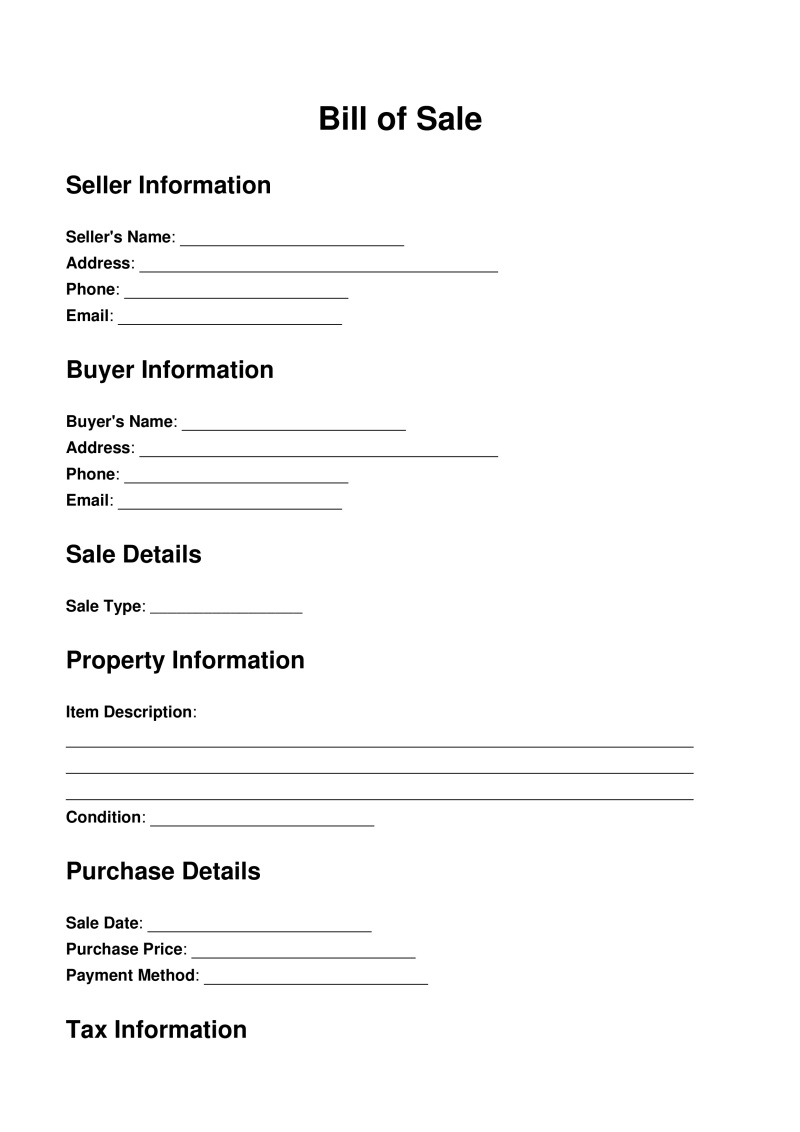

The heart of the bill of sale is the document completion phase. Your bill of sale should include a detailed description of the property being transferred. This description should be specific enough that the property can be clearly identified.

Include these key elements:

- The agreed-upon sale price and payment terms

- The exact date of the transaction

- Complete contact information for both buyer and seller

- All relevant property identification numbers/title

- A clear description of the property's condition

Be thorough when documenting any known defects or issues with the property. This transparency protects the seller from future claims. Specify whether any warranties are being provided or if the sale is being conducted "as-is." Document any conditional agreements related to the transfer, such as payment plans or contingencies.

3. Finalizing the Transaction

Both parties must sign and date the bill of sale to make it official. In some jurisdictions, you may need witness signatures or notarization to make the document legally binding. Note the payment method used and whether payment has been received in full at the time of signing.

Ensure both parties receive copies of the completed and signed bill of sale. This step is often overlooked but is essential for record-keeping. Exchange any additional required documents such as titles or registration papers that accompany the transfer of ownership.

4. Post-Transaction Responsibilities

After the sale, both parties should retain copies of the bill of sale. The recommended retention period varies by jurisdiction and asset type, but keeping these records for at least 3-5 years is generally advisable. The buyer typically needs to register the change of ownership with relevant authorities, especially for vehicles, boats, or firearms.

The seller may need to report the sale for tax purposes, particularly for high-value items or business assets. If the property had any liens against it, ensure these are properly released and documented as part of the transaction process.

State Laws on Signing a Bill of Sale

The rules governing the signing of a bill of sale differ across the United States. While some states have minimal requirements, others impose strict guidelines, especially for high-value items like vehicles or boats. Below is a general breakdown of signing requirements, followed by notable state-specific variations. Always check your state’s Department of Motor Vehicles (DMV) or equivalent agency for the most current regulations.

Common Signing Requirements Across States

- Seller’s Signature: Nearly all states require the seller to sign the bill of sale to validate the transfer of ownership.

- Buyer’s Signature: Many states recommend or require the buyer’s signature, though it’s not universally mandatory unless specified.

- Notarization: Notarization adds legal weight by verifying the identities of the signers. Only a handful of states mandate it for vehicle sales, while others leave it optional.

State-by-State Signing Variations

Here’s a snapshot of how signing requirements vary across the 50 states, focusing primarily on vehicle bills of sale (the most regulated type). Note that these are general trends as of March 2025, and laws may evolve:

- Alabama: Both buyer and seller must sign. Notarization is not required but recommended for vehicle sales.

- Alaska: Seller’s signature is required; buyer’s signature is optional. No notarization needed.

- Arizona: Seller must sign; buyer’s signature is not mandatory. Notarization is not required.

- Arkansas: Both parties should sign. Notarization is optional unless specified by the county.

- California: Seller must sign; buyer’s signature is not required. Notarization is not needed for vehicles.

- Colorado: Seller’s signature is required; buyer’s is optional. No notarization unless transferring a title with a lien.

- Connecticut: Seller must sign; buyer’s signature is recommended. Notarization is not required.

- Delaware: Both buyer and seller must sign. Notarization is optional.

- Florida: Seller must sign; buyer’s signature is optional. Notarization is required for boats but not cars.

- Georgia: Seller’s signature is required; buyer’s is optional. Notarization is not mandatory.

- Hawaii: Both parties must sign for vehicles. Notarization is not required.

- Idaho: Seller must sign; buyer’s signature is optional. No notarization needed.

- Illinois: Seller must sign; buyer’s signature is not required. Notarization is optional.

- Indiana: Seller must sign; buyer’s signature is optional. Notarization is not required.

- Iowa: Seller must sign; buyer’s signature is recommended. No notarization needed.

- Kansas: Seller must sign; buyer’s signature is optional. Notarization is not mandatory.

- Kentucky: Seller must sign; buyer’s signature is optional. Notarization is not required.

- Louisiana: Both buyer and seller must sign, and notarization is required for vehicle sales.

- Maine: Seller must sign; buyer’s signature is optional. Notarization is not required.

- Maryland: Seller must sign; buyer’s signature is optional. Notarization is required for vehicles.

- Massachusetts: Seller must sign; buyer’s signature is optional. No notarization needed.

- Michigan: Seller must sign; buyer’s signature is optional. Notarization is not required.

- Minnesota: Seller must sign; buyer’s signature is optional. No notarization needed.

- Mississippi: Seller must sign; buyer’s signature is optional. Notarization is recommended but not required.

- Missouri: Seller must sign; buyer’s signature is optional. Notarization is not required.

- Montana: Both buyer and seller must sign, and notarization is required for vehicle sales.

- Nebraska: Seller must sign; buyer’s signature is optional. Notarization is required for vehicles.

- Nevada: Seller must sign; buyer’s signature is optional. Notarization is not required.

- New Hampshire: Seller must sign; buyer’s signature is optional. Notarization is required for vehicles.

- New Jersey: Seller must sign; buyer’s signature is optional. Notarization is not required.

- New Mexico: Seller must sign; buyer’s signature is optional. Notarization is not mandatory.

- New York: Seller must sign; buyer’s signature is recommended. Notarization is not required.

- North Carolina: Seller must sign; buyer’s signature is optional. Notarization is recommended but not required.

- North Dakota: Seller must sign; buyer’s signature is optional. Notarization is not required.

- Ohio: Seller must sign; buyer’s signature is optional. Notarization is not mandatory.

- Oklahoma: Seller must sign; buyer’s signature is optional. Notarization is not required.

- Oregon: Seller must sign; buyer’s signature is optional. Notarization is not required.

- Pennsylvania: Seller must sign; buyer’s signature is optional. Notarization is recommended but not required.

- Rhode Island: Seller must sign; buyer’s signature is optional. Notarization is required for vehicles.

- South Carolina: Seller must sign; buyer’s signature is optional. Notarization is not required.

- South Dakota: Seller must sign; buyer’s signature is optional. Notarization is not mandatory.

- Tennessee: Seller must sign; buyer’s signature is optional. Notarization is not required.

- Texas: Seller must sign; buyer’s signature is recommended. Notarization is optional but common for vehicles.

- Utah: Seller must sign; buyer’s signature is optional. Notarization is not required.

- Vermont: Seller must sign; buyer’s signature is optional. Notarization is required for vehicles.

- Virginia: Seller must sign; buyer’s signature is optional. Notarization is not required.

- Washington: Seller must sign; buyer’s signature is optional. Notarization is not mandatory.

- West Virginia: Seller must sign; buyer’s signature is optional. Notarization is required for vehicles.

- Wisconsin: Seller must sign; buyer’s signature is optional. Notarization is not required.

- Wyoming: Seller must sign; buyer’s signature is optional. Notarization is required for vehicles.

States Requiring Notarization for Vehicle Bills of Sale

As of March 14, 2025, the following states typically require notarization for vehicle transactions:

- Louisiana

- Maryland

- Montana

- Nebraska

- New Hampshire

- Rhode Island

- Vermont

- West Virginia

- Wyoming

FAQs

A bill of sale can facilitate title transfer for certain types of property, particularly vehicles. While not universally sufficient, it is often a crucial document in the title transfer process. Motor vehicle departments typically require:

- Completed bill of sale

- Proof of ownership (original title)

- Valid identification

- Payment of transfer fees

The specific requirements vary by jurisdiction. For motor vehicles, the bill of sale must usually be accompanied by the existing title, signed over by the previous owner. In some cases, additional documentation may be necessary to complete a legal title transfer.

Notarization is not universally required for a bill of sale. Requirements vary by jurisdiction and transaction type. However, notarization provides additional legal authenticity, verifies the identities of parties involved, and can offer stronger evidence in potential disputes.

Discussion

1 commentComments and opinions expressed by users on this website are for informational purposes only and do not constitute legal advice. They reflect the personal views of the commenters and should not be relied upon as a substitute for professional legal counsel. Always consult a qualified attorney for advice specific to your situation.

Comments (1)

Leave a Comment

Caroline Brin

2 weeks ago

Great template—simple, clear, and easy to fill out. It included all the important details like buyer/seller info, item description, and payment terms. Very useful, thanks!