Invoice Template

About this document

An invoice is a document from a seller to a buyer that details goods or services provided, costs, and payment terms, serving as both a payment request and a transaction record.

By Type

Invoice Generator

Use the invoice maker below to generator your custom invoice.

What is an Invoice?

An invoice is a document issued by a seller to a buyer that outlines the details of a transaction. It includes the products or services provided, the quantity, price, and total amount due for payment. Invoices also often include payment terms, such as the due date and accepted methods of payment.

How to Make an Invoice

Step 1 - Create a Template

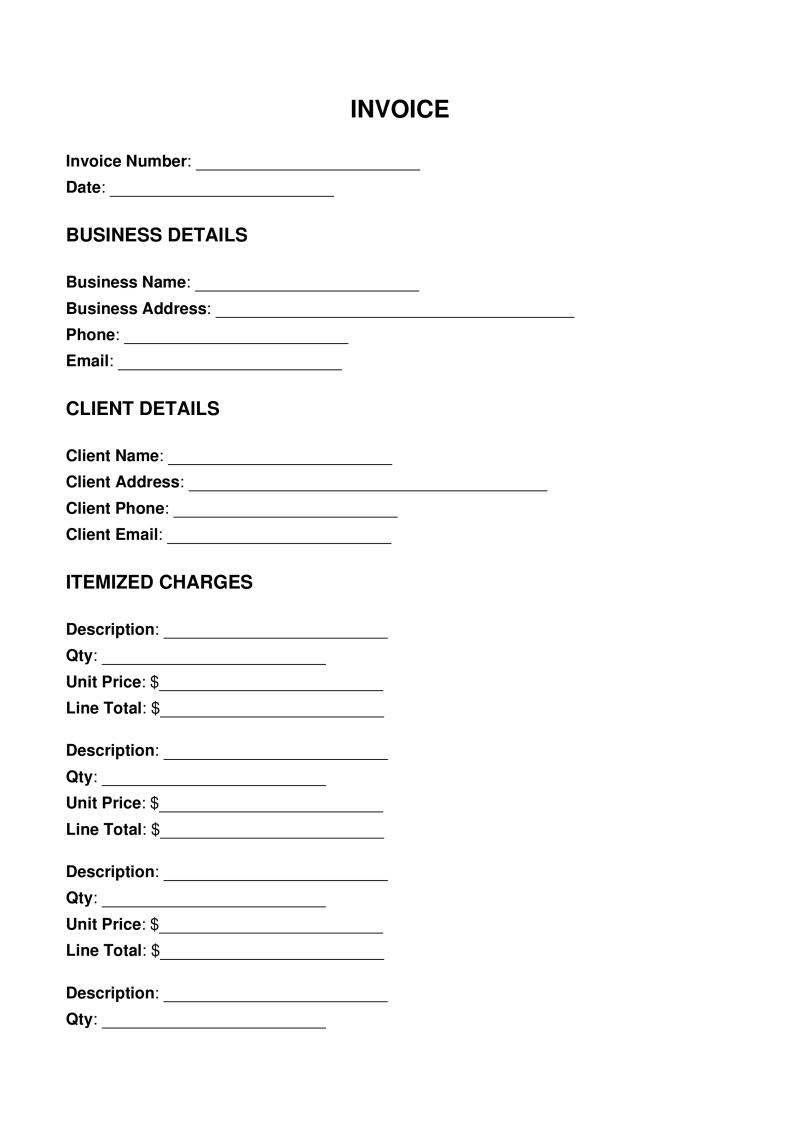

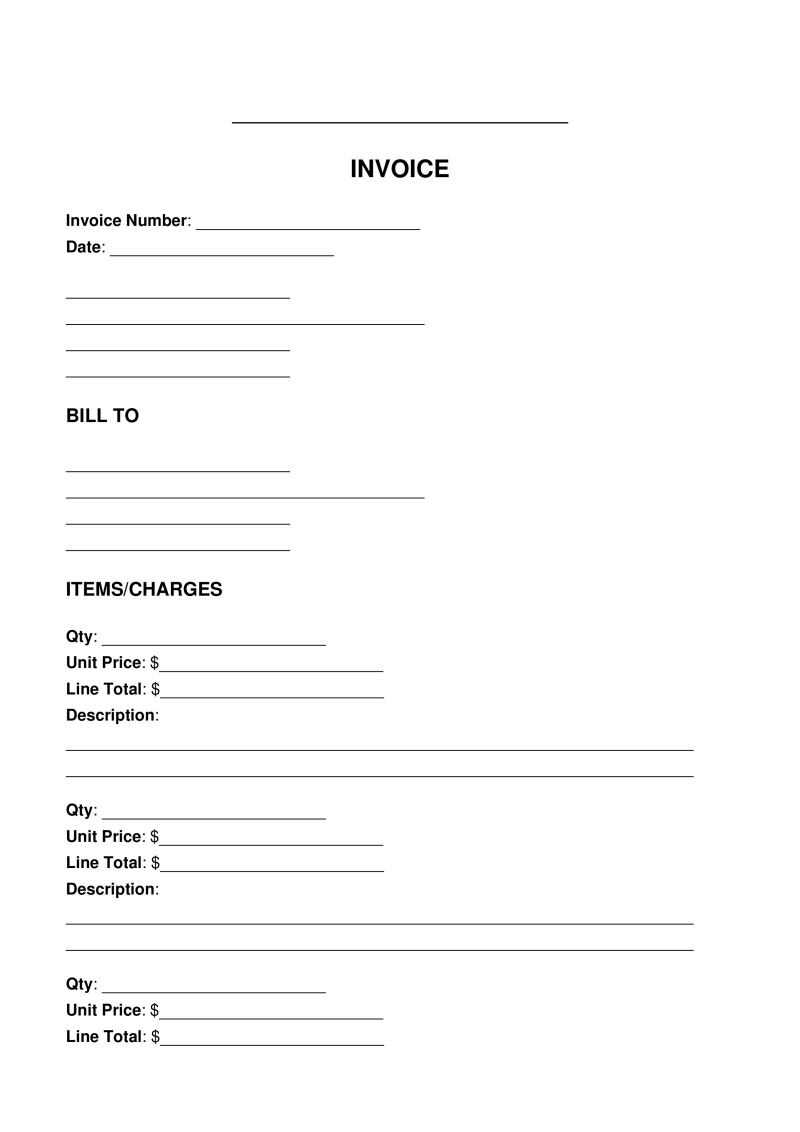

Establish a standard invoice template containing business identification elements, contact information, and payment details. Essential components include invoice number, date fields, customer data section, and structured areas for services or products.

Use our Invoice Generator to create your invoice.

Step 2 - Populate Information

Complete the template with transaction-specific information including the unique invoice number, relevant dates, customer details, itemized descriptions of services or products rendered, applicable rates, quantity measurements, tax calculations, and the final payable amount.

Step 3 - Send the Invoice

Transmit the completed invoice to the client either in advance of service/product delivery (for prepayment requirements) or following completion, depending on established payment terms. Electronic distribution via email represents the predominant method in contemporary business practices.

Step 4 - Record Management

Implement a systematic approach to invoice monitoring, documenting the status of each transaction. This tracking mechanism may range from basic spreadsheet solutions to dedicated accounting software platforms.

Step 5 - Payment Resolution

Institute a structured process for addressing unpaid invoices, including a sequence of communication attempts with increasing formality as the payment exceeds the established due date.

FAQs

An invoice receipt is a document that combines an invoice and a receipt, detailing goods or services provided, their prices, and total amount due, while confirming payment received. Issued by a seller to a buyer, it’s used when payment follows shortly after invoicing, streamlining records. Legally, it proves a completed transaction, supporting tax filings or audits.

To draft an invoice, start with a clear header labeled "Invoice" and include your business name, logo, address, and contact details at the top. Add the buyer’s name and address below. Assign a unique invoice number and date it (e.g., mm/dd/yyyy). List the goods or services provided in a table, including descriptions, quantities, unit prices, and subtotal amounts. Calculate the total due, adding any applicable taxes or discounts. Specify payment terms (e.g., "Due within 30 days") and accepted methods (e.g., bank transfer, check). Finally, include a polite note thanking the buyer and providing payment instructions. Keep it concise, professional, and easy to read.

Discussion

1 commentComments and opinions expressed by users on this website are for informational purposes only and do not constitute legal advice. They reflect the personal views of the commenters and should not be relied upon as a substitute for professional legal counsel. Always consult a qualified attorney for advice specific to your situation.

Comments (1)

Leave a Comment

Caroline Brin

2 weeks ago

Clean layout and easy to customize. Made billing quick and professional-looking. Very handy—thanks!